Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Would you like to create a personalized quote?

Rance DeWitt

Office Hours

Address

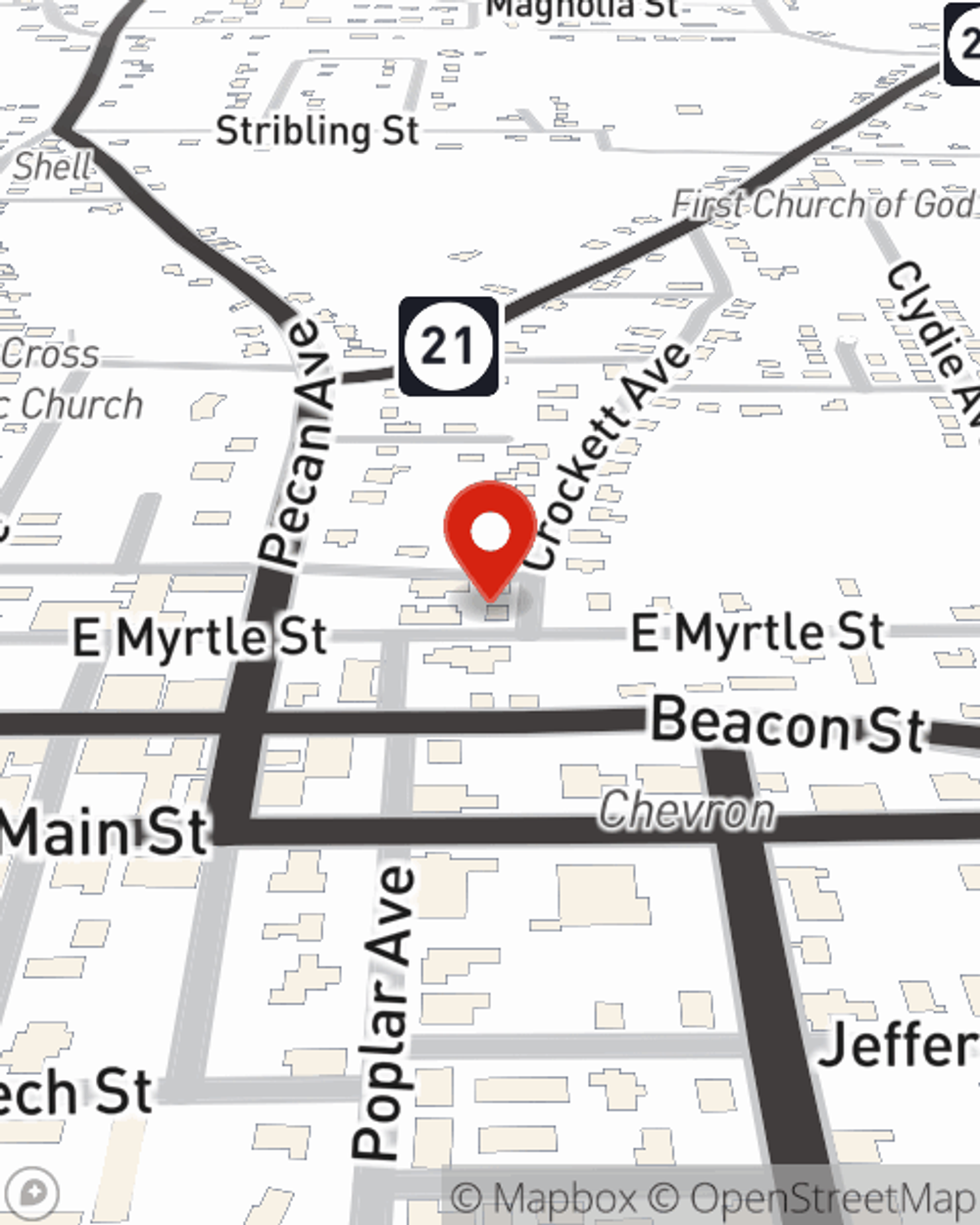

Philadelphia, MS 39350-2966

Across the street from the Philadelphia Utilities

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

-

Phone

(601) 656-2481 -

Fax

(601) 656-2546

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Office Info

Office Info

Office Hours

-

Phone

(601) 656-2481 -

Fax

(601) 656-2546

Languages

Simple Insights®

How to use the 50/30/20 budget rule

How to use the 50/30/20 budget rule

Balance your personal spending and saving with the 50/30/20 budget rule. Discover how much should be used for everyday needs, wants and savings.

The Real Consequences of Drunk Driving

The Real Consequences of Drunk Driving

What's at stake if you're caught drunk driving? A lot. These tips help you avoid the dangers of drinking and driving.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Social Media

Viewing team member 1 of 1

Pansy DeWitt

Office Manager

License #10473351